Living Within Your Means: A Guide to Financial Well-being

Introduction

Is living within your means actually possible? In a world filled with temptations and desires, it's easy to fall into the trap of living beyond our means. This not only jeopardizes our financial stability but also adds unnecessary stress to our lives. In this comprehensive guide, we'll explore the reasons why people tend to overspend, the consequences of doing so, and most importantly, how to break free from this cycle and achieve financial well-being.

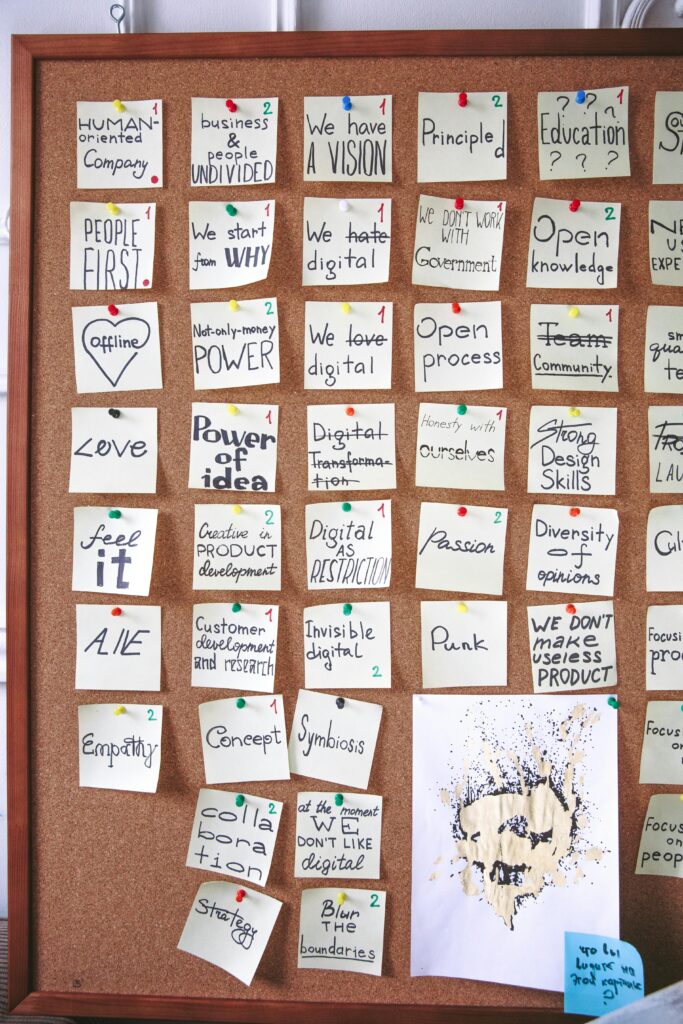

**1. Understanding the Urge to Overspend

The Influence of Consumer Culture

Living in a consumer-driven society, we are constantly bombarded with messages encouraging us to buy more, have more, and experience more. Understanding this external pressure is crucial in overcoming the urge to overspend.

Emotional Spending

Often, overspending is linked to our emotions. We shop to feel better, to cope with stress, or to reward ourselves. Recognizing these emotional triggers is the first step towards curbing impulsive spending.

Breaking the Consumerism Spell Taking a step back to evaluate our needs versus wants helps in prioritizing spending. Creating a budget aligned with our financial goals provides a roadmap for responsible spending.

**2. The Consequences of Living Beyond Your Means

Debt Accumulation

One of the most significant consequences of overspending is the accumulation of debt. Whether through credit cards, loans, or financing, the debt cycle can quickly spiral out of control.

Stress and Anxiety

Financial stress is a leading cause of anxiety and can impact both mental and physical health. Breaking free from the cycle of overspending can alleviate this stress and improve overall well-being.

Debt-Free Living Embracing a debt-free lifestyle requires discipline and commitment. Paying off debts systematically and avoiding new ones are essential steps in achieving financial freedom.

**3. Budgeting: Your Path to Financial Freedom

Creating a Realistic Budget

A well-structured budget is the foundation of responsible financial management. It helps in tracking income, controlling expenses, and saving for the future.

Emergency Fund Importance

Building an emergency fund acts as a safety net, preventing the need for unplanned borrowing in times of unexpected expenses.

Budgeting Tips for Success Regularly reviewing and adjusting your budget ensures it remains aligned with your financial goals. Being mindful of your spending habits and making intentional choices contribute to budgeting success.

**4. Investing in Your Future

Importance of Saving

While budgeting focuses on managing day-to-day expenses, saving is about planning for the future. Establishing a savings habit is a key component of financial well-being.

Building Wealth

Investing wisely allows your money to work for you. Whether in stocks, real estate, or retirement accounts, building wealth requires a long-term perspective.

Financial Freedom Through Investment Educating yourself about different investment options and seeking professional advice empowers you to make informed decisions, propelling you towards financial freedom.

Conclusion

Living within your means is not about deprivation but rather about making intentional choices that align with your values and long-term goals. Breaking free from the cycle of overspending requires self-reflection, discipline, and a commitment to financial well-being. By understanding the consequences of living beyond your means and implementing practical strategies like budgeting and saving, you can embark on a journey towards financial freedom.

Frequently Asked Questions (FAQs)

- How can I control emotional spending?

- Recognizing emotional triggers is the first step. Creating a list of alternative activities to engage in when emotions run high can help divert the impulse to spend.

- What is the best way to start budgeting?

- Begin by tracking your current expenses to understand your spending patterns. Then, set realistic financial goals and create a budget that aligns with those goals.

- Why is an emergency fund important?

- An emergency fund acts as a financial cushion, covering unforeseen expenses without resorting to loans or credit cards, helping you maintain financial stability.

- How do I start investing with limited funds?

- Start small and gradually increase your investments. Many investment platforms allow you to begin with minimal amounts. Diversifying your investments reduces risk.

- Can I enjoy life while living within my means?

- Absolutely. Living within your means is not about deprivation but about making mindful choices. Budgeting allows you to allocate funds for enjoyable experiences without compromising financial stability.